Every year at this time, Canadians are flooded with advertisements regarding RRSPs and how it’s time to top them up. What makes RRSP Season is the rule that if you make any RRSP contributions in the first 60 days of this year, you can write them off against last year’s income. This provides you with a tax planning opportunity that can be a powerful tool if you utilize it properly. Unfortunately, my experience is that the RRSP is something that many people don’t fully understand. It is a great savings tool for your future, but how and why? Let’s take a minute to review what an RRSP is, how it reduces your income tax payable and the other long-term benefits of investing in one.

In this Article:

- What is an RRSP?

- What are the Tax Benefits of an RRSP?

- I’ve Heard of Tax Brackets, but I’m Not Sure What They Mean to Me

- How Much Can I Deposit into my RRSP?

- What About RRSP Loans? Is this a Good Idea for Me?

- What Should I Do During this RRSP Season?

What is an RRSP?

This is one of those things that I find confusing people. An RRSP is not an actual thing. You cannot go out and buy an RRSP. According to the Government of Canada’s website:

An RRSP is a retirement savings plan that you establish, that the CRA registers, and to which you or your spouse or common-law partner contribute. Deductible RRSP contributions can be used to reduce your tax. Any income you earn in the RRSP is usually exempt from tax as long as the funds remain in the plan. You generally have to pay tax when you receive payments from the plan.

So, an RRSP is not a thing; it is a way to register an account so that it receives a particular tax treatment from the Canada Revenue Agency. I used to illustrate the idea of an RRSP as being similar to a box. The box can hold a wide variety of investment products (think mutual funds, segregated funds, stocks, bonds, and even GICs), and once it goes in the box, it has different tax rules applied than it would outside the box. You don’t buy a new box every year; you put more into the one that you already have.

What are the Tax Benefits of an RRSP?

At its heart, the idea of an RRSP is a deal that you make with the government. That deal is that you take the money that you made this year, and you promise to put it into an account that you aren’t going to use until you retire. The government’s role in the deal is that they agree to give you back any income tax that you paid on money going into that account this year. They also won’t tax the account as it grows, but it comes with the understanding that when you take money out in the future, you will pay taxes on it at that time. Let’s look at the advantages of an RRSP for you as a taxpayer.

- Immediate Tax Relief – Since your RRSP contributions are deductible from your income, you can reduce your tax owed this year by making a contribution. So, if you made $100,000 last year and deposited $5000 into your RRSP, you only owe tax on $95,000 of income even though you made more than that.

- No Taxation on Investment Growth – RRSP accounts are not taxed annually on any investment growth that happens within them. This allows your savings to grow faster because you do not have to account for a tax bill generated by your investment.

- Favourable Tax Rates on Withdrawal at Retirement – The foundation that the RRSP system is built on is that, in the vast majority of cases, Canadians will be in a lower tax bracket when they retire than they were while they were working. This means that the amount of tax you pay when you withdraw money from your RRSP to support your retirement should be less than the credit you received writing the deposit off while you were working.

I’ve Heard of Tax Brackets, but I’m Not Sure What They Mean to Me

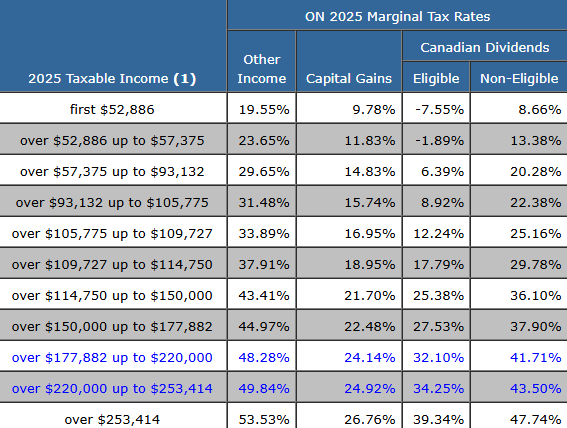

Income taxes in Canada are based on something called a marginal tax system. The most important thing for a marginal tax system is understanding the ‘tax brackets’ and how much tax you would pay on the next dollar you earn. The marginal tax system means that you pay a different amount of tax on different amounts of your income. This is easiest to explain by including a chart. You may have heard this from the federal government but to make sure, starting in July of 2025, there was a reduction in the lowest personal federal tax rate. They are moving it from 15% to 14%. This will be implemented over two years so this year the first 0.5% was applied, lowering the rates in the two lowest combined federal/provincial marginal rate brackets compared to 2024. In 2026, the remaining 0.5% will be applied so that the overall reduction of 1% applies. In this example, I will use the rates you pay in Ontario for income tax in 2025.

(Source – https://www.taxtips.ca/taxrates/on.htm)

Here’s how it works. If you made $100,000 in taxable income from your job (i.e. not dividends or capital gains) in 2025 in Ontario, you pay:

- 19.55% tax on the first $52,886

- 23.65% on the next $4489

- 29.65% on the next $35,757

- 31.48% on the next $6868

When you run all of the math, taking into account the basic personal exemptions, in Ontario, you would owe $21,182 in income tax on $100,000 of taxable income (Source –https://www.eytaxcalculators.com/en/2025-personal-tax-calculator.html)

The reason for understanding how the marginal tax system works is that when you make an RRSP contribution, you reduce your taxable income. So, carrying on with the same example. If you make $100,000 in taxable income and contribute $10,000 to an RRSP, you would receive a tax deduction equal to:

- $2162.04 on the first $6868 of RRSP contribution

- $928.64 on the remaining $3132 RRSP contribution

So, If you reduce your taxable income to $90,000 by depositing $10,000 into an RRSP, you reduce the amount of tax you have to pay by $3090.68. If the payroll deducted income taxes worked perfectly from your employer and you had no other write-offs or taxable income, this means that your RRSP contribution would get you a tax refund of $3090.68

As you can see, the further down you drive your income, the lower the ‘bang for your buck’ as far as tax relief from RRSP contributions. This is one of the reasons why working with an independent financial advisor is key. People love the idea of paying less tax, but there comes a time when adding to your RRSP doesn’t provide you with the income tax relief that would justify making the deposit. Remember earlier when it was pointed out that one of the key advantages of the RRSP is the idea that you will be in a lower tax bracket in retirement than you are while you are working? If you drive your income down into the lowest bracket using RRSP contributions, you lose out on that advantage in the future. are working? If you drive your income down into the lowest bracket using RRSP contributions, you lose out on that advantage in the future.

How Much Can I Deposit into my RRSP?

Because it is a tax-deferred environment, the Canadian government has limits on how much money you can put into your RRSP. For 2025, that limit was 18% of your earned income, up to a maximum of $32,490. When you make a deposit into your RRSP, it reduces the amount of contribution room you have, but if you don’t use all of the room that year, that unused amount accumulates. For example:

- Earnings of $100,000 generates $18,000 in RRSP contribution room (18% of your income because it is below the annual limit).

- You deposit $10,000 to your RRSP this year, the unused $8000 in space can be used in future years.

The amount of total RRSP contribution room you have can be found on your Notice of Assessment or on the CRA website. This is really important information to know when you are putting money into your RRSP. The reason is that there is a penalty for over-contributing to your RRSP. There is a bit of leeway, but if you exceed your RRSP contribution room by more than $2000, you will be charged a penalty of 1% per month for the amount that you are over your limit until the situation is resolved.

As an example, if you overcontribute by $5000, the penalty would be calculated based on this:

- $5000 (total overcontribution) minus $2000 (allowable overcontribution amount)

= $3000 (amount you will be penalized for)

- The penalty is $30 (1% of $3000) for every month that the overcontribution remains in your RRSP

If you ever overcontribute to your RRSP, you should tell the CRA as soon as you notice. After that there is a process that you follow to remove the overpayment to stop the monthly penalties from accumulating.

What About RRSP Loans? Is this a Good Idea for Me?

An RRSP loan is when you borrow money specifically for the purpose of investing it in your RRSP. It is different from borrowing to invest in non-registered investments (known as leveraging) in one key way. You will pay interest on the RRSP loan, but it is not tax-deductible, as is the case with other types of investment loans. This is because the investment you place the borrowed funds into is not taxed as it grows. With that in mind, what can an RRSP loan do for you?

- It will make your RRSP contribution larger. This gives you more money in your account to compound over the years, which can help you in the future.

- It will reduce the amount of income tax that you owe. A larger RRSP contribution reduces your taxable income and results in you owing less tax overall. It may even generate a tax refund for you.

But is it a good idea for you? That depends on a few factors. The tax bracket you are in is a very important factor. Also, making sure that the loan can be paid back is essential. One of the ways to pay back the loan is if you are able to generate a tax refund large enough that you can pay off the loan right away. Here is an example of this situation:

- If you are making $100,000 a year and you have made pre-authorized monthly RRSP contributions equal to $4800 for this tax year ($400 a month) you would receive a $1511 tax refund in Ontario.

- Now, if you take out a $3000 loan, your total RRSP contribution is increased to $7800. In Ontario, this generates a tax refund of $2439.

- You could then use this $2439 as a repayment on the $3000 loan, leaving you with only $561 of the loan to repay.

There are ‘sweet spots’ for most higher earning individuals where, if you make monthly contributions to your RRSP, you can figure out how much of a loan you could take out where the extra amount of contribution the loan generates is offset by the tax refund, and you could essentially apply your tax refund into your RRSP, allowing it to grow and help fund your retirement.

What Should I Do During this RRSP Season?

Remember, the idea of the ‘RRSP Season’ is the product of being able to make an RRSP contribution in the first 60 days of this year that you can write off against last year’s income. This provides you with a tax planning opportunity based on knowing what you earned last year. How you take advantage of this time on the financial calendar is a highly individualized question, so the best answer is to seek out the advice of an independent financial advisor. Talking to the team at Strata Wealth & Risk Management is a great place to start. The reason to seek out an independent advisor and not simply go to your local bank branch is that an independent advisor will seek out the best solution for you, offered by a wide variety of companies. What they will not do is try to sell you products that are linked directly to one institution because they have sales quotas to meet in order to keep their job. Getting good advice is key; watch this to find out why an independent advisor is your best route. An independent advisor will work with you to create a long-term plan that takes into account a variety of things, including your long-term goals and any short-term tax planning opportunities, to provide you with a financial plan that guides you toward retirement.