Anyone who has watched the news for the past few months knows that we are in a period of massive political turmoil, which has had wide-ranging effects on all aspects of our daily lives. As Canadians, we have watched the federal Liberal Party select a new leader who will be our 24th Prime Minister. The unknown aspect of who will become our next Prime Minister and how that will shape policy going forward in Canada pales in comparison to what we are being faced with from our neighbours to the south.

As most people are aware, Donald Trump was sworn in in January for his second term as President and immediately began making decisions about economic policies that have created havoc around the globe. What we have seen recently is that the waffling on trade policies and other saber-rattling that is coming out of the Oval Office has created an overall feeling of unease and uncertainty. Unfortunately, and history has borne this out many times, there are few things that investment markets like less than uncertainty.

As an investor, if you don’t know what is going to happen next, how do you account for it in your decision-making process? What if you also couldn’t seem to apply logic to predict what would happen next? With this in mind, I thought it might be a good time to take a look at why uncertainty is so stressful in investment markets and what an investor should do during this time of turmoil.

How Does Uncertainty Affect Markets?

When it comes to traditional factors influencing investment markets, we know how things like changing interest rates or companies announcing that they have met, missed, or exceeded earnings targets affect the markets. These are normal announcements that will trigger increases or decreases in market valuations that are predictable based on the data that is provided.

The Role of Policy Uncertainty

Uncertainty over policy is a harder one to measure, though. This is because it isn’t empirical. There is no numerical value, like central bank interest rates, that can be cited as the measurement of uncertainty. Interestingly, there is a gauge known as the Economic Policy Uncertainty Index, which measures the number of news stories that refer to the economy, uncertainty, and political policy. If you look at this, you will see a pretty steady uptick in this index as the change of power at the White House grew closer.

Unfortunately, we are at the point in time where the messaging from the President is creating turmoil. He has announced and then ‘paused’ the application of tariffs to goods from both Canada and Mexico several times, and he seems (surprisingly?) upset when retaliatory tariffs are announced. Markets don’t know what will be announced, and this makes for really uncertain times.

To put it in a nutshell, fear of the unknown makes investment markets jittery. When you can’t predict what is going to happen, how do you plan for it? The answer is that you can’t, so instead, what you see is that people pull back to limit their exposure to the risk that the unknown presents. That is the problem that markets are facing. With so much unknown going on, how do you make a plan? High levels of uncertainty from factors outside the regular influences of investment markets inflame feelings that things are vulnerable and can lead to people making bad choices.

What Do The Experts Think?

One of my favourite things to do when I am wondering about how investment markets react to something is to look online and see if Warren Buffet has any commentary about a particular topic. You can imagine that he has an opinion on uncertainty and how it affects investors.

(Source: https://www.azquotes.com/author/2136-Warren_Buffett?p=26)

Buffet, who is one of the most successful investors of all time, has long been an advocate of not trying to time the markets but instead buying sound investments and holding on to them for extended periods. He is famed for saying that for him, his ‘favorite holding time is forever’, meaning that when he buys something he doesn’t plan on selling it. Buy and hold; do not try and time the market.

The reason for this is that no one knows how to time the market effectively. Anyone who tells you stories of this was likely the benefactor of good luck, not some sort of clairvoyant who knew in advance what was going to happen. If buy and hold is the kind of strategy that is applied by one of the most successful investors of our time, it should also work for you.

But I am Losing Money! I Have to Do Something!

I hear you- there is an emotional response to seeing what is going on and feeling like you need to do something. No one likes to see the value of their savings going down. It prompts a feeling of loss within you, and you feel like you need to do something, anything, to make it stop.

Step One: Evaluate Your Current Portfolio

Before taking any action, take a moment to review your investments.

- What is the current breakdown of the holdings in your investments? Take a look at your portfolio and see what it is made up of. You should be able to see a lot of data on it, and one of those things is a geographic breakdown of your holdings. This should help you figure out if you are exposed to the turmoil or if it is white noise around the edges of your investments.

Step Two: Revisit Your Risk Tolerance

- How did you land in your portfolio to begin with? This is the big one. I guarantee you that during the setup of your account, you went through a risk tolerance questionnaire. One of the things that you would have discussed would have been your reaction to downturns in the market and how you would respond to significant ones. The answers that you gave here were applied to how your investment mix was created.

Doing Nothing is a Choice

“Sure,” you may be thinking, “I answered that risk tolerance question, and it helped me choose the amount of risk in my portfolio, but that was theoretical risk. I am losing real money now, and I don’t like the way that feels”. This leads to thinking, ‘I have to do something’. I encourage you to consider this. Doing nothing and staying the course is doing something.

As long as you know that when you answered the questions on your risk assessment to begin with, you were truly expressing how you feel, then the path you are on is what you need to continue with. An emotional response to a circumstance like this will not get you your desired outcome. There is a real consequence to bailing out of an investment. Don’t believe me? Let’s take a look at real data.

The Cost of Missing the Best Market Days

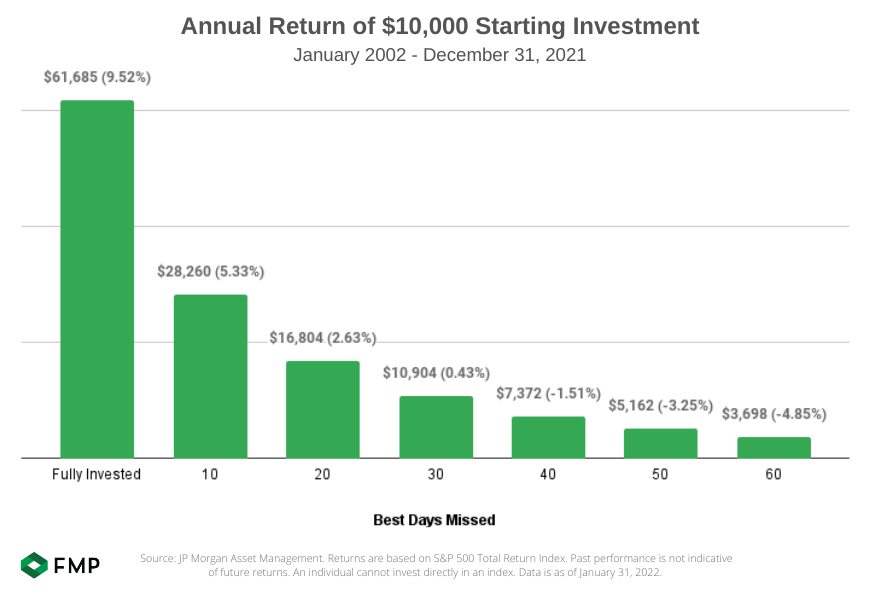

In this example, you invested $10,000 at the start of January 2002 and held it until December 2021 in an index fund that mirrored the S&P 500. You have choices. You can stay invested for that entire time, or you could react with emotion to ‘bad days’ on the market and sell things and then reinvest when you feel like the turmoil is over.

Before you say this time is different, the time frame in the example includes the time when COVID-19 came to be and the global pandemic with all of its instability and unknown rocked the entire globe. One of my favourite things that I have learned over the years is that even though the underlying reason may vary, this time is never different, and the faster you see that, the better off you will be.

Because a picture says a thousand words, here you go.

(Source: https://fmpwa.com/the-cost-of-missing-the-10-best-days-in-the-stock-market/)

What this shows is that if you stayed in the markets and rode out all the ups and downs, you would end up with a 9.52% rate of return, and your $10,000 investment would be worth $61,685.

However, if you sold and then bought again and just by chance missed the ten best days on the market over those 20 years, you only have $28,260 and a rate of return of 5.33%. If your market timing efforts resulted in you missing anything in excess of the best 30 days on the market, you gave up all your growth and potentially even lost money.

Out of 20 years, do you know what percentage of time 30 days makes up? I do. It is 0.41%. Less than 1% of the days you should have been invested can cost you 100% of the growth in your account.

Closing Thoughts

This is important enough that it bears repeating. Sir John Templeton was once quoted as saying that ‘the investor who says “this time is different”, when in fact it’s virtually a repeat of an earlier situation, has uttered the four most costly words in the annals of investing. This was in a letter he wrote to clients during an economic recession in 1954.

Think about that: the more things change, the more they stay the same. In the 1950s or the 2020s, your response to market uncertainty needs to be the same. You need to understand that while market uncertainty doesn’t feel good, it also doesn’t necessitate action from you.

Don’t choose to disrupt a sound financial plan because you feel like you need to respond to something that is making you feel uncomfortable emotionally.

This is also a great time to reach out to your financial advisor and review your plan. If you don’t have a plan, reach out to the team at Strata Wealth & Risk Management and they can help you create your plan so when you feel the urge to make that emotional decision you can fall back on the plan and the remind yourself of the reasons you used to set things up to begin with and avoid making a mistake you may regret in the future.