Warren Buffet is famously quoted as saying, ‘It’s only when the tide goes out that you learn who has been swimming naked.’ How does this apply to people’s investment plans? As advisors, we see people all the time who want to jump into the stock market during periods of positive returns. These same people often aren’t prepared for any declines in the value of their investments. When a bull market turns into a bear, you see all the people who have been chasing returns instead of properly planning their investments, trying to run for the hills. The analogy is particularly poignant given that much like the highs and lows of the tides, the market cycles through highs and lows. Much the same as how the tide has never come in and forgotten to go back out, market corrections happen. Market downturns are inevitable, and you need to be prepared for their effect on your portfolio. To finish flogging the swimming analogy to death, if you enjoy swimming in the positive return years, you better be prepared for what happens when the markets shift. If you find yourself wanting to jump out of the ocean and run, you may be one of the people who was swimming naked. So let’s discuss everything you need to know about marketing volatility and your investments.

In This Article:

- Investing is Emotional (but it shouldn’t be)

- But I’m Losing Money (I told you we’d address this)!

- An Important Thing to Understand

- I Like to See these Facts in Pictures!

Investing is Emotional (but it shouldn’t be)

Think back in time to when you started your investment plan. You had a goal in mind and a time frame for when you were trying to achieve it. Maybe you were saving for your children’s education, maybe for a major purchase like a cottage or maybe it was to build up your nest egg for when you retire. Now, try and remember what happened when you started saving for this goal. You probably sat with an advisor who worked with you to determine what your risk tolerance was and helped you blend your portfolio so that it reflected the amount of risk that you were comfortable with. One of the questions in this risk assessment often deals with how long you would be willing to hold on to an investment that is going down in value. The thing about this question is that it’s easy to say that you would hold on for one, two or even three years when it’s theoretical. When you actually get a statement that shows a drop in the value of your plan in the past six months, that isn’t so theoretical anymore. You lost money (not really, more on that later), and something needs to be done, and it needs to happen now! You know that you talked with the advisor about riding out the ups and downs of the markets, but that was before it affected you personally. Now that I have something real on the line, throw reason out the window! Emotions take over, but should you let emotions influence you when making logic-based decisions? We all know the answer is no, but that requires an outside perspective. It’s easy for me to sit here and write about taking emotion out of the process; it’s not me losing money (again, not really; the explanation for that is coming). If your investment plan was sound, to begin with, the worst thing you can do is make an emotional response to this type of thing.

But I’m Losing Money (I told you we’d address this)!

Think about someone you know who has a collection of something. I am going to use hockey cards as an example. If they are serious collectors, they likely have an idea of what their cards are ‘worth .’The thing is, you can think that the Pavel Bure (I cut my teeth as a hockey fan while cheering for the Canucks) rookie card you got in a pack you paid $3 for is worth a lot of money. Here’s the big question, though: until you sell it, is it really worth anything more than you paid for it? If it was worth $500 one year and then only $400 next year, did you lose $100? Now, I know you’re thinking, “Why is he talking about hockey cards? I came here to find out about investment risk”! Here’s the parallel that I will draw. The fund units in your investment portfolio are not worth more or less than what you have deposited into them until the day that you sell them. That’s really the bottom line. If you panic as the result of turmoil in the markets and sell fund units when they’re down in value, you have taken what was a theoretical loss and made it real.

Now, I get that emotional responses are hard to overcome. The feeling that you have to do something is overwhelming. You may find that your investment fund company doesn’t help either. In my opinion, there is typically a major shortfall in the reporting of investment returns on semi-annual statements. Why should I care what the change in my investment plan in the last six months is? If I deposited $10,000 into the plan over its lifetime, and six months ago, it was worth $15,000, and today it’s worth $13,000, did I ‘lose’ $2000? I actually didn’t. I have less growth in my plan, but I haven’t lost any money. To push it even further, unless I sell my fund units, that $13,000 isn’t real either. I know that I mentioned this earlier, but it bears repeating. Until you sell an investment, the real value to you is what you have put in, so why would you choose to react emotionally to a decrease in the market values of your investment and make the smaller amount of growth real?

An Important Thing to Understand

All investors need to understand that you will not earn big returns from ‘risk-free’ investments. At its most basic, there are two categories of investments most people utilize. They invest in equity investments (think stock market) and interest investments (bonds, mortgages etc.). Equities are higher in volatility than interest investments, and they have the potential for higher returns every year because of that. By taking the chance that your investment could go down in value, you could also be rewarded with higher returns. If your returns are linked to what interest rate is being earned on them (a GIC as an example), your returns are going to be limited. People talk about having medium risk tolerance in their investment plans. The risk in your portfolio is a sliding scale that is influenced by how you blend the equity and interest investments. To get a medium level of risk, you will be exposed to some of the volatility that exists on the stock market. Make sure when you are working with your financial advisor to determine your risk tolerance that you are going to be okay with the downside risk. Don’t get caught up chasing big returns in a portfolio if you can’t stomach the ups and downs.

I Like to See these Facts in Pictures!

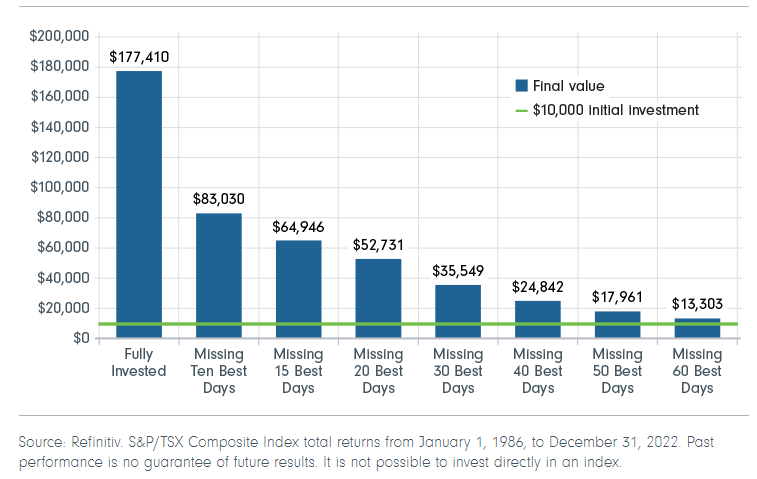

Do you remember when Chicken Little announced to the world that ‘The sky is falling! The sky is falling!’? When you see the media covering a downturn in the stock markets, that is what they would really like you to believe. As investment advisors, we regularly are faced with clients who have ‘seen what’s happening on the news’ and feel like they need to do something! Here’s the thing, though: you need to remember why you set up your investment plan in the first place and why you selected the investments that are in your plan. If the reasoning was sound when the plan was set up, the fact that there will be volatility in your returns is included in your plan. Timing the stock market is impossible. And trying to do it is super risky. If you don’t believe it, have a look at this graph:

$10,000 invested in the TSX on January 1st, 1986, would be worth $177,410 on December 31st, 2022, if all you did was invest and forget about it. The time frame we are talking about includes 13,513 days. If, instead of staying invested, you moved the money out of the market and, through what turns out to be tremendously bad luck, you missed the best ten days of returns out of the 13,513 total days, that total value of your investment drops to $83,030. Think about that…10 days is equal to 0.074% of the total time, and it resulted in the value of the investment being 53.2% lower. These results are truly startling. If you missed the best 60 days during that period (0.44% of the total time), your investment is worth 92.5% less than it would have been simply by riding the ups and downs.

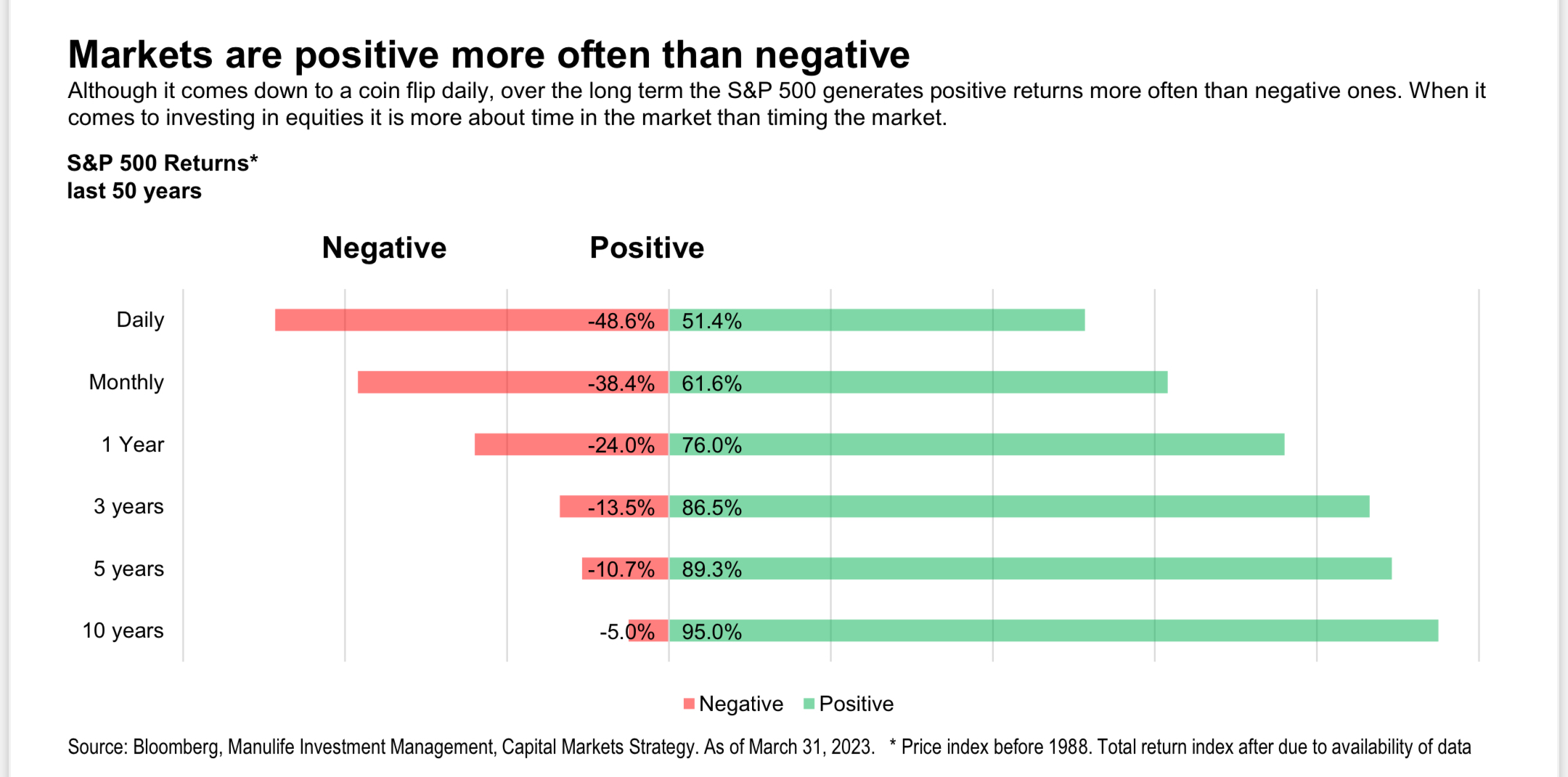

One more graph that I feel drives home the point.

This really shows how timing the market is next to impossible and that simply choosing the proper investments and staying in them for the long term is the best strategy. To put the picture into words, over the past 50 years, approximately half of the days the S&P 500 is positive, and half of the days are negative. The longer you hold the investments, though, the more it skews towards positive returns. There is only 5% of the time in the past 50 years where if you bought and held onto your investments, you had a negative return over a ten-year period. That means that 95% of the time if you bought and held, you had growth after ten years.

When you look at these two graphs together, you can really see how the market favours people who buy and hold investments. Trying to time things is a fool’s game; unfortunately, everyone has a friend who got lucky once and talks about it. Now, they want to do the same thing. I feel a bit like a broken record, but the timing doesn’t work. Invest in a portfolio that holds the proper blend of different investment categories and ride it out. Your future self will thank you for taking this approach. Work with your advisor, set up a fundamentally sound approach to begin with, and remember emotional responses to uncontrollable situations simply don’t help you achieve your goals.