Generation X (born between 1965 and 1980) grew up during a time of unprecedented changes in the world. As a card-carrying member of Gen X, I grew up without a cell phone, email address, or internet access. I actually remember a time when you could not simply look something up on your phone whenever you wanted to. But before I sound too much like an old man yelling at clouds, I will address the title of this article.

Retirement for people from Generation X is likely to look different than it has for older generations. Based on what we see currently, here are a few things that Generation X faces as its members look toward the future.

In this article:

- The Fears Facing Generation X

- What Solutions Are Available?

- Other Factors that Generation X Should be on the Lookout for

- Is Retirement The End of the World As We Know It? Should you Feel Fine?

The Fears Facing Generation X

The oldest members of this generation turn 60 this year. This means that the reality of retirement is starting to stare them right in the face. There are a number of fears that are common themes for Gen X’ers as retirement grows closer. The common ones include:

- I will not have enough money to enjoy the retirement I want.

- Inflation will make things unaffordable for me.

- I will never be able to save enough money to actually retire.

- I may be forced to go back to work after I retire.

- How do I balance helping my kids and planning for my future?

- I will reach retirement and still have a mortgage.

Any one of these thoughts on its own is stressful. When you start to combine them, it becomes clear that many people who are getting close to retirement have significant worries about how they will make it through.

What Solutions Are Available?

When we run retirement plans for clients, we are forecasting what they are doing right now into the future. Your retirement savings will be influenced by a few different factors:

- How long you want to work

- What rate of return you expect

- How much you are able (and willing) to save for the future

Let’s look at each of these in more detail and see how they could affect your retirement plans.

How Long You Want to Work

This can come in a couple of forms.

The first is when you see a retirement shortfall and decide to delay your retirement date in order to continue working for a few more years. This can often help your overall plan because of two factors. The first is that you add more time in what are typically your peak earning years to build your savings. The second is that it delays the start of drawing down your savings. If you are age 65 and need to delay retirement, you may also be able to take advantage of increases in your government retirement benefits by waiting until after age 65 to start collecting them. Alternatively, you can consider beginning to collect your government benefits and contributing them to your RRSP. This approach negates any tax implications while you work and increases the amount you are putting away for retirement without affecting your monthly cash flow.

The second option available to you is partial retirement. This may appeal to many members of Generation X. It is the concept of the “side hustle.” Many people do not love the idea of retiring and never working again. Instead, they value the flexibility to do what they want, when they want. For many, this means working a little, but not necessarily in a 40-hour-a-week job. The income from this type of work can make a significant difference in retirement because it reduces the amount withdrawn from your savings and helps prolong the life of your investments.

What Rate of Return on Investments Should You Expect?

In a study conducted by Natixis Investment Managers on Generation X as they approach retirement, it was found that Canadian Generation X investors expect 10.2% as their long-term rate of return. At the same time, financial professionals believe that 6.5% is a more realistic expectation. This creates a 57% spread between what investors want and what professionals feel they should expect.

Generation X has lived through many intense investment market booms and busts in their lifetimes. Looking back on the markets during the time Generation X members would have been investing, these downturns include Black Monday in 1987, the Dot-Com Bubble, the 2008 Global Financial Crisis, and the 2020 COVID-19 crash. Together, these events contributed to the TSX averaging a rate of return of 7.94% from 1971 to 2021.

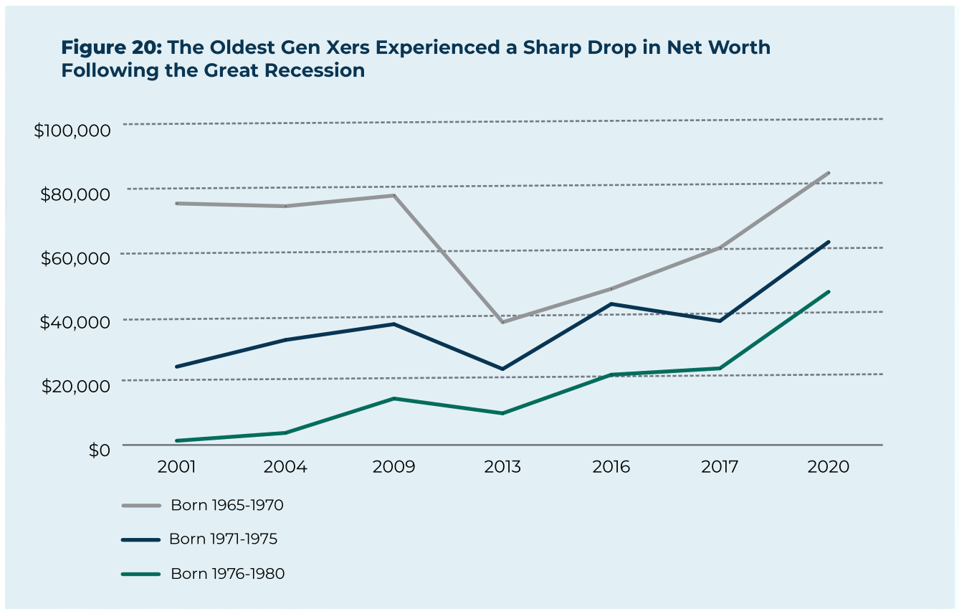

If the stock market returns are only 7.94%, it is not reasonable to expect over 10%, and it is even less reasonable when you consider the need to make portfolios less volatile as retirement approaches. Why then does Generation X feel they need over 10% growth? Perhaps there is an explanation in what you see when looking at the 2008 financial crisis and how it affected Generation X members:

(image source: https://www.forbes.com/sites/dandoonan/2023/07/26/generation-x-on-the-brink-the-stark-reality-of-their-grim-retirement-outlook/)

This image is particularly concerning to the oldest cohort of Gen Xers, who also happen to be the closest to retirement right now. They experienced the largest drop in their net worth and took the longest time to recover from the hit. For many people born between 1965 and 1970, it took almost 10 years for their net worth to recover the losses from 2008. The takeaway here is that these individuals feel the need to expect higher than average rates of return because, without them, achieving their retirement goals will be exceedingly difficult.

How Much to Save For the Future?

This is always the big question. And in a message that repeats itself throughout our blog archives, the best way to figure this out is to have a written financial plan in place. A proper plan accounts for the growth rate of your investments, your life expectancy, and the effect that inflation will have on your expenses. It also needs to account for your plans for how you want to spend retirement and what that will cost.

If this is not something you already have and you do not feel comfortable doing it yourself, reach out to the team at Strata Wealth & Risk Management and speak to one of the advisors. They will help you establish a plan and then monitor it on an ongoing basis to make sure you stay on track to meet your changing goals over the course of your life.

The earlier you set up your plan, the more impact small changes in the amount you are saving will have, given the effect of compound growth over the years. The downside for Gen X’ers is that the advantage of time is evaporating. The youngest members still have more time to let growth benefit their plan, but older members may face the reality that they need to save larger amounts to achieve their goals because they do not have the same time for investment growth to aid them.

Having a financial plan in place is truly the only way to understand how much you need to invest to achieve your goals.

Other Factors that Generation X Should be on the Lookout for

As we approach the time when many of the latchkey kids will begin to retire, we see a few factors that shape the retirement landscape Generation X faces. For example:

- Many people in this generation have not been able to rely on their employers to provide pensions. In most cases, the defined benefit pension plan in the private sector is gone. Most often, only people who have worked for the government (directly or indirectly) will have the advantage of guaranteed pension income in retirement.

- Rising health care costs will play a role in decisions. If you want to retire prior to age 65, you need to consider how you will pay for health care. Retiring means no longer having access to employer health plans, so you need to be prepared to cover your own costs. This challenge is magnified by the fact that these costs increase every year.

- Be aware of being part of the “sandwich generation.” Many Generation X members will face the reality of supporting aging parents at the same time they are helping their children establish themselves as adults. This can place real strain on retirement planning because of the financial pressure associated with supporting family members.

A well-thought-out financial plan can help you account for many of these factors, making it easier to navigate the obstacles you face on your path to retirement.

Is Retirement The End of the World As We Know It? Should you Feel Fine?

That was a test. If you really are a member of Generation X, you are probably humming a tune from REM right now. Extra kudos to you if you know the words. It was quite an achievement to be able to sing along when this song came on the radio!

Aside from that brief trip down memory lane, hopefully, if this article applies to you, the idea of retirement is not the end of the world. Yes, Generation X faces unique challenges when it comes to retirement, but we also live in a time with access to so much information and so many experts that there are options available to help you feel fine.

Take the time to talk to the advisors at Strata Wealth & Risk Management to come up with a plan you can follow to achieve your retirement goals.